Most bookkeepers are familiar with QuickBooks software, so it’s easy to find someone to assist with your accounting needs. Xero and QuickBooks Online are both Web-Based Services, which means you can log in and access your account from anywhere with an Internet Connection. Both services do offer an app marketplace, for both in-house mobile apps and integrations or extensions offered by third-party services. Xero offers more integrations overall, but both are very comprehensive. While the vocabulary may vary between the two products, they both offer electronic banking, excellent invoicing, payment acceptance, and bill management capabilities. The platform’s reporting suite is among the most powerful we encountered while reviewing accounting software.

- When it comes to accounting software, that usually means checking your bank or payment service accounts against the transaction records in the software.

- Additionally, some users complained that QuickBooks Online is a bit expensive.

- Both solutions performed very well in our testing, with QuickBooks earning an overall score of 4.7 out of 5 from our accounting experts, compared to Xero’s 4.5 out of 5.

- We have an extensive history of reviewing small business accounting software, and we stay up-to-date with the latest features and enhancements.

- Both Xero and QuickBooks Online have their own versions of transaction tracking tags, but QuickBooks Online is the winner in this arena.

Expense and mileage tracking

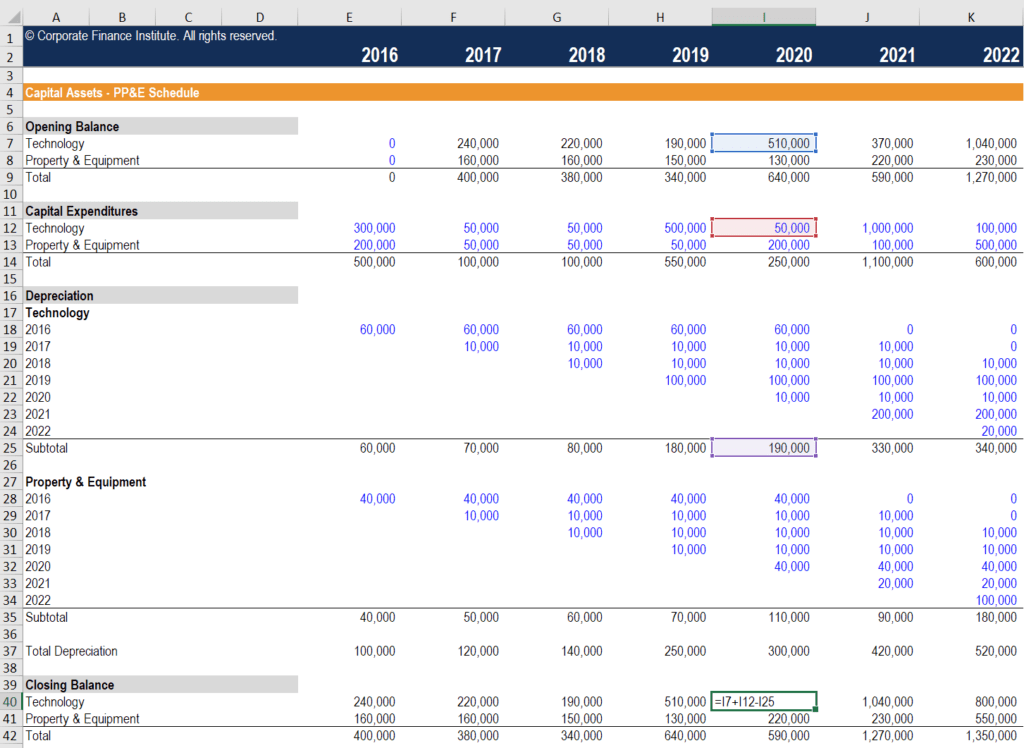

Yes, both have a fixed asset manager that allows you to track fixed assets and calculate depreciation. Fixed asset accounting is part of all Xero’s plans, while it’s offered only in the most expensive plan of QuickBooks Online—Advanced. This includes the availability of integrations for payroll, time tracking, and receiving e-payments. We also evaluated whether an electronic bill pay integration was available.

Making the Call: Choosing the Right Software for Your Business

QuickBooks bills itself as ‘smart, simply accounting software – with no commitment’⁴. It’s particularly good at helping businesses to streamline repetitive a divestiture strategy that delivers success for your business tasks, and manage accounting processes from just their smartphone. Xero’s payroll is through a deep integration with a third-party service called Gusto.

Xero vs QuickBooks: Which Is Right For Your Business in 2024?

Contractors who deal with multiple currencies will find Xero better in this scenario. Plus, you can turn your estimates into work orders and invoices in just a few clicks. After all, the success of your projects — from allocating resources to managing finances efficiently — lies in proper scheduling. When making the Xero vs. QuickBooks comparison, consider the job scheduling features.

Canada Tax Codes Explained – Guide for UK Employers

Video training courses, a blog, and a community forum are also available. Both QuickBooks and Xero let you set up automated data tracking and report generation, but QuickBooks has more granular options, making it faster to compare reports against historical data. You’ll still be able to accomplish everything you need with both, but it’ll be a little faster with QuickBooks. Neither QuickBooks or Xero offers a permanent free plan, but if that’s what you need, we have a guide to the best free accounting software.

Integrate Xero or Quickbooks with Wise Business and start saving money on international payments

They can include an invoice PDF link and a button to online invoice in the reminder email. QuickBooks simplifies finance management by allowing users to organize receipts and track mileage easily using its mobile application. Use for Accounting, bookkeeping, payroll, invoice, expense tracking. As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs.

It also includes a hub to view all projects, making the correct labor costs, payroll, and expenses for each easy to manage. The QuickBooks Simple Start plan costs $30 per month and supports one user, making it best for very tiny businesses or for a single freelancer. Features include expense tracking, contact management, and unlimited invoices and estimates.

Higher-tier plans include unique features, like workflow rules, on top of tools that help you measure project profitability. Phone support and live chat support are available 24/5 to all paying customers, but third-party integrations are limited compared to QuickBooks Online and Xero. It’s most basic ‘Starter’ plan is for sole traders and startups and offers up to 20 invoices/quotes and 5 bill payments a month.

Xero lets users create two active tracking categories, while QuickBooks Online allows users to create 40 in the Simple Start, Essentials and Plus plans. QuickBooks Online’s Advanced plan allows for unlimited tag groups. The more categories you create, the more reports you can run to get a better idea of how your business functions and where there’s room to grow.

On top of that, we were disappointed that Xero’s expense-tracking tools are only available with its costliest pricing package. This is the exact opposite of QuickBooks, which makes these tools available to equity accounting all customers. All Xero pricing plans include 24/7 online customer support; you can cancel with one month’s notice. We went to user review websites to read first-hand reviews from actual software users.

Companies that deal with multiple currencies and need to add employee time in the invoice. QuickBooks has been in the market for longer than Xero, is very well-developed, and is generally loved by accountants – especially in the US market, which QBO has dominated. QBO claims that customers find on average $3,534 in tax savings per year. Smart Reporting, powered by Fathom, provides tools to analyze your business metrics. Overall, the pricing of Xero vs QuickBooks Online is mostly determined by the size of your company and the features that are most important to you.

This includes snapping pictures of your receipts and uploading them via your phone. Xero is slightly more expensive than QuickBooks, but it doesn’t have limitations when it comes to users (although the cheaper plan does have some restrictions). You can also cancel anytime with QuickBooks, whereas Xero requires a month’s notice of cancellation. Your choice depends on your specific needs, budget, and how you like to work.

Are you torn between QuickBooks and Xero for your business accounting needs? These two powerhouses dominate the accounting software market, each with its own strengths. The user experience is as important as any feature of your accounting solution. New users, even non-experts, should be able to quickly understand how to use the software. A major selling point of Xero is that you can have unlimited users on your account. Both QuickBooks and Xero offer apps for Android and iOS so you can track and manage your accounting information on the go.

Both solutions also allow you to tag different categories of expenses. However, Xero only allows four total tracking categories — two active and two archived. All of the QuickBooks Online plans, on the other hand, let users create up to 40 tags. The cheapest plan, Early, lets you send 20 invoices and enter five bills. For example, you can’t bulk reconcile transactions, and you don’t have access to Xero’s most advanced analytics. Accounting software for your business can be an invaluable tool for managing your expenses, monitoring your financial health, paying taxes, and more.

If you often need to record bills and bill payments on the go, Xero’s mobile app might be preferable. A satisfied Xero user shared that the program is the most user-friendly accounting software on the market. Xero can be easy to use after you become familiar with it, but we believe QuickBooks Online is generally more intuitive and easier place value crossword puzzles to set up. We have an extensive history of reviewing small business accounting software, and we stay up-to-date with the latest features and enhancements. Our first-hand experience, guided by our internal case study, helps us understand how the different products compare with each other and how they work in real-world scenarios.